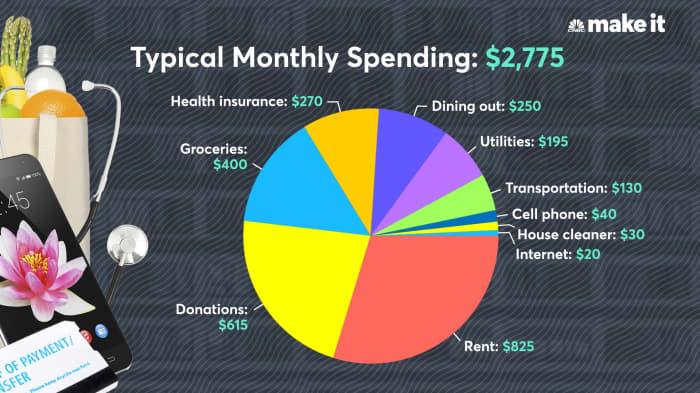

But putting aside how much money he has to spend, people are questioning about the amounts that he supposedly spends. Some seem extraordinarily high and others laughably low. See their chart below:

Now most people thought the laughably low amounts were rent (there's no way you can find a place in Boston for that little), cell phone, internet, and house cleaner. Now if you actually read the article, you see that he has 4 roommates so most of those expenses are split between 4 people. And he's on his family's cell phone plan (lucky) which is why that's so low. Of course the biggest thing is, who has $615 to donate EVERY MONTH? I guess if you live with 4 other people and make 100k you could. But also, like, he doesn't have any entertainment? And you're saying he doesn't have student loans he has to repay? Hmmmmm

Now I'm fine with all of this. My problem is that it is unrealistic for most people so not really helpful to see what a normal budget should be like. He makes much more than most of us and it is a bit crazy to expect everyone to live with 4 other people. And if you are like me and are in a committed relationship, you'd like to have some sort of semblance of a private home for you. Is that too much to ask for in life?

So it got me thinking, though I'm sort of a stickler for spending money, I don't really "budget". I honestly had no idea how much we spend monthly on a lot of things. I keep a record of how much comes in and how much goes out so I know if we can make a large expense or not, but fortunately my husband and I make enough that we don't have to save up for essentials. We can live comfortably in our somewhat minimal lifestyle. So I wanted to see how we fell compared to this person. Here's my breakdown (keep in mind it is for 2 people in the San Francisco Bay Area):

Typical Monthly Spending: $3,209

Breakdown:

Our largest expense is rent. And it's actually going up $100 next month. It has consistently been raised at least $50 every 6 months. For perspective, we have a tiny one bedroom apartment, and it is still one of the best deals in our area.

Our smallest expense is health insurance. You can't even see it on the chart since it's only $2 a month thanks to Covered California. We bank on the fact that we won't have to go to the hospital much since we are young and healthy and without kids.

Our utilities only average about $50 a month. The good thing about a tiny apartment, we only have to pay for gas and electric and it doesn't take much energy for the small space!

Our cell phone (for 2 people mind you) is only $80 a month with MetroPCS (read my review here). That's with unlimited everything. Seriously people, why are you paying hundreds for your cell phone?

Our transportation costs may be a little higher than most since my husband drives for Lyft. The good thing is we get a lot of that as a tax deductible expense and we actually make money off of the mileage because we have Priuses. Read about driving for rideshare companies here.

Most of our other expenses I would imagine are pretty normal. But I'm curious how others stack up. What's your spending breakdown like?